Background

BJP Led NDA party released its last budget on 1st of February 2019. This budget was designed in a way to please the middle man and farmers in order to attract and widen the vote base. There are some entities who have been the beneficiaries of this budget. Large budget allocation to Agriculture, Film Industry and Armed forces have actually made a difference in this budget.

Interim Budget: It is not a full-fledged budget, since the next lok sabha elections are near and the task of framing the full budget is to be left to the newly elected government. It seeks funds for the existing government to spend in the months before the elections. Conventionally, during any normal year of elections, Government announcing interim budget do not make a lot of changes and policy announcements, but the present Government did a lot of these announcements and huge claims which created a lot of buzz in the economy.

Budget Highlights

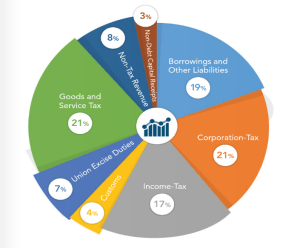

The three major Highlights of the Finance Minister Piyush Goyal in his maiden budget which shook the Equity markets and various industries were: First being the tax exemption to middle class salaried people earning less than 5 lakh per annum, second being the amount of Rs 6000 being annually transferred to farmers owning land less than hectares land, third is the mega pension scheme for informal sector workers. The budget outlay for this year is Rs 27.84 lakh Crore and the revised estimates of previous year was Rs 24.5 lakh crore. Therefore there is an increase of 13% in this year’s outlay. The figures below indicate the major items of revenue and expenditure for this budget.

Source: Dun and Bradstreet 2019-20 budget analysis

Source: Dun and Bradstreet 2019-20 Budget analysis

Sectoral Analysis

Agriculture Sector

The total outlay for Agriculture and allied activities this year is Rs 1499.81 billion, a rise of 73% from the revised estimates of previous year. Government has proposed to launch Pradhan Mantri Kisan Samman Nidhi (PM-Kisan), under which farmers owning land upto 2 hectares will be receiving an annual amount of Rs 6000 directly in their bank accounts on an installment basis. The budget has proposed an outlay of Rs 750 billion for this scheme.

Kisan Credit Card: A comprehensive drive to bring all the farmers under kisan credit card is being proposed under this budget. Also an attempt will be made to make it user friendly. The prime motive of this scheme is that farmers should get easy access to credit.

Cows: Rashtriya Kamdhenu Aayog scheme is being promoted in this budget which focuses on sustainable and genetic up gradation of cow resources and to enhance productivity of Cows.

Social Sector

Allocation towards Social welfare sector saw an increase to Rs 493.4 bn. Various other schemes such as MGNREGA, Child Development Scheme and rural development received an increased allocation in this year’s budget allocation. Allocation for Health sector was expectedly increased to Rs 635.4 bn in FY 20 according to the budget estimates. Major emphasis is being led on Pradhan Mantri Jan Arogya Yojana, since the investment increased to Rs 65 bn in FY20. For highlighting the role of the BJP Led Government in increasing the access of health care, this budget has also proposed to set up 22nd AIIMS in Haryana.

Infrastructure and Education sector has also being an important part of this budget. In rural Infrastructure, government is aiming to create 1,00,000 digital villages over next five years. An increased amount of budget is being allocated to develop the north eastern part of India, and hence the allocation has been increased by 21% in FY20. The government to introduce container cargo movement to North East by improving the navigation capacity of Brahmaputra River.

Railways

Government has announced the highest ever capital expenditure for railways in this budget which has amounted to Rs 1.58 trillion with an increase of 14.3%. Vande Bharat express, an indigenously developed semi high-speed train is to be launched.

Media and Entertainment

The government has proposed single window clearance for Indian filmmakers and regulatory provisions will rely more on self-declaration.

Budget 2019 new schemes

PRADHAN MANTRI KISAN SAMMAN NIDHI SCHEME

Under this scheme, Government has announced that vulnerable landholding farmer families, having cultivable land up to 2 hectares, will be provided direct income support at the rate of Rs 6000 per year in three equal installments of Rs 2000 each. Under the Kisan Credit Card Scheme, the budget has now proposed 2% interest subvention for farmers pursuing animal husbandry or anyone affected by natural calamities like Kerala, Assam and Andhra Pradesh.

An important proposition is to increase the minimum support price (MSP) by 1.5 times the production cost for all 22 crops, a long pending demand of farmers of the country.

PRADHA MANTRI SHRAMYOGI MAANDHAN SCHEME

This scheme proposes to provide fixed monthly pension of Rs 3000/month for all organized and unorganized sector. Workers will benefit after age 60 and it is applicable to individuals below Rs 15000 of monthly income. Those enrolled at the age of 29, will have to pay Rs 100 while those enrolled at age of 18 will have to pay Rs 55. The party claimed that it could be the world’s biggest pension scheme for unorganized sectors.

INCOME TAX EXEMPTION RAISED

The most important proposition in this budget regarding the income tax exemption is that the salaried employees earning income less than 5 lakh a year are exempted from tax and the TDS threshold on interest earned on bank deposits has been increased from Rs 10,000 to Rs 40,000. Deduction on tax on rent has also been increased from Rs 1.8 lakh to Rs 2.4 lakh. Tax slabs have been kept intact.